Its been long time since my last post tagged as business and finance related topics. As past few days I've been informed to write an essay on the above topic in order to pass the first round assessment of my application for a unit trust research analyst position in iFast capital, I just like to give it a try despite I've been working in a bank now as I am interested to get an idea on my ability to become an analyst in investment field. Below is my essay on the topic:

Resulted from sub-prime crisis and Greece sovereign debt problem, developed countries especially Euro which leaded by US market suffering financial stagnant all the while since 2008, even though it appears sometime when there were few signals of economic recovery, but it seems can’t last long and remain stagnant still. There is no doubt that the US situation has implication on Malaysia and region stock market, however, I would like to point out that those implications may temporarily effect local investors’ psychology and sentiment in stock market, nevertheless, it will bring minimum impact towards our strong economic fundamental in the long run.

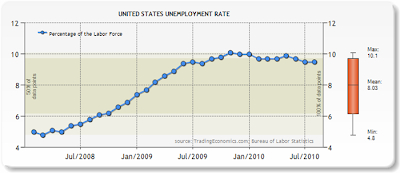

Let’s take a look at the past few months economic data and indicators, although US unemployment rate shown a significant rise in the past few months, the country’s housing data and production index also shown a dissatisfied result as well, however Malaysia’s economic indicators showed positive result, as well as stock market performed well in the same period and the FTSE KLCI index achieved 1400 points and above recently.

To strengthen the point, we may have a look at our country’s export statistics as shown in the chart below, our gap between export toward ASEAN and South countries (exclude Japan) compared to export volume to US and EU countries had became wider in recent years. This fact shows that developed countries demand are no longer a major determiner on our economic, while emerging countries have a more important role instead. In addition, there are lots of unexplored potential markets in the emerging countries (Brazil, Russia, India and China) awaiting Malaysian to explore extensive business opportunities.

Our economic health in that similar period also supported by recent profit jumping showed in most listed companies’ quarter financial reports, among those companies comprised from banking, automobile, service and else.

Another reason why Malaysian investor should take into consideration is our currency rate. As we all know, Ringgit had came to a high level against US currency at RM3.1/USD compared to previous level, and our currency had been the most impressive one among the region’s currencies, and it is optimistic to expect that Ringgit can keep strengthening against USD.

For those interested in developed market, in the short run, market may perform volatile trend due to the unstable economic environment; however, due to their strong basic fundamental, it is confident that they will rebound in the long run from the financial crisis, after all, US and EU counties had learned a lesson through the devastating financial crisis, and therefore taking action to control and tighten the financial policy.

In a nutshell, except for those who like to gain profit especially from the developed market investment in short term, otherwise Malaysian investors who invest in local market and nearby region countries should not worry about the slow growth in developed countries in the long run.

投资前就要谋定退路

-

投身投资市场,从不是靠一时的运气赌涨跌,而是以基本面为锚,做足万全的准备。于我而言,每一次出手买入前,必把投资方案做细做实,不仅要想透退路、定实止损策略,更要明确止盈目标——不是对标的缺乏信心,而是深知,再优质的基本面,也抵不过市场的无常,唯有提前谋定,才能在变化中守住自己的节奏。

市场从没有绝对的“好标的...

1 hour ago

0 comments:

Post a Comment